Are you tired of financial uncertainty, constantly wondering where your hard-earned money disappears each month? Taking control of your finances through budgeting is not just a good idea; it's the cornerstone of financial freedom.

The quest for financial stability often begins with a fundamental question: how can I effectively manage my income and expenses? The answer lies in the power of a well-crafted budget. A budget acts as a roadmap, guiding your financial journey and ensuring that every dollar serves a purpose. It's the tool that allows you to plan and track where your money goes, empowering you to stay in control of your finances and, ultimately, achieve your financial goals. Many people, when starting this process, find themselves seeking recommendations and wondering how to find the best way to begin, or if a budgeting spreadsheet is the right tool for the job.

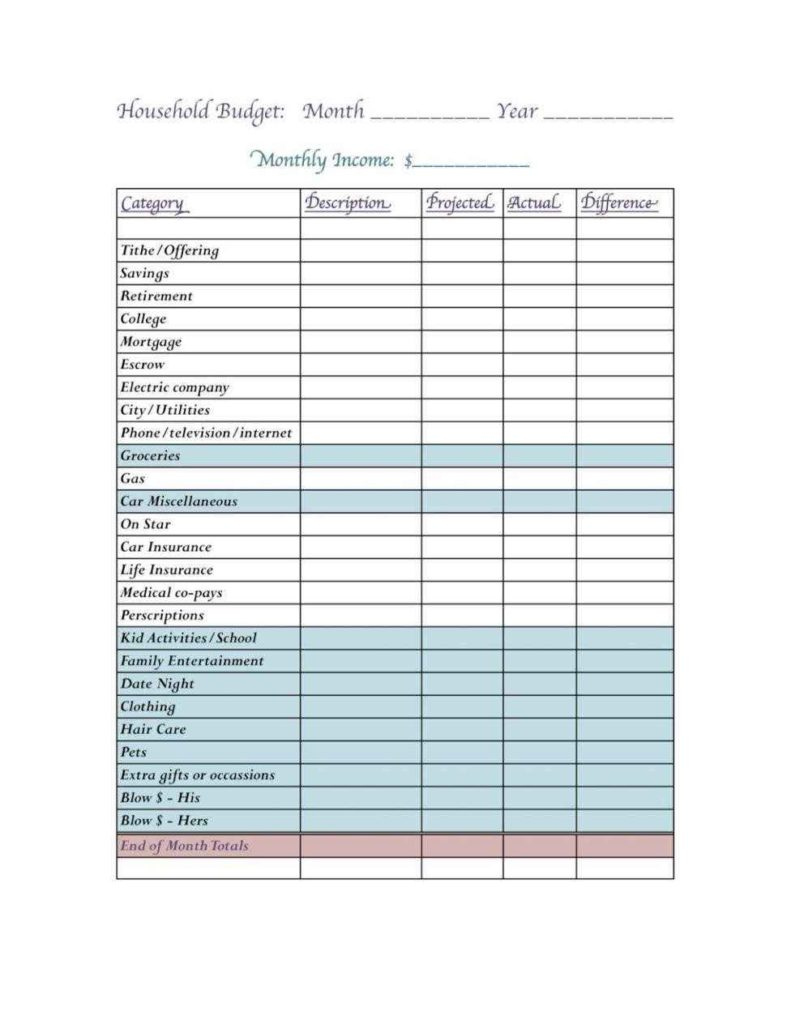

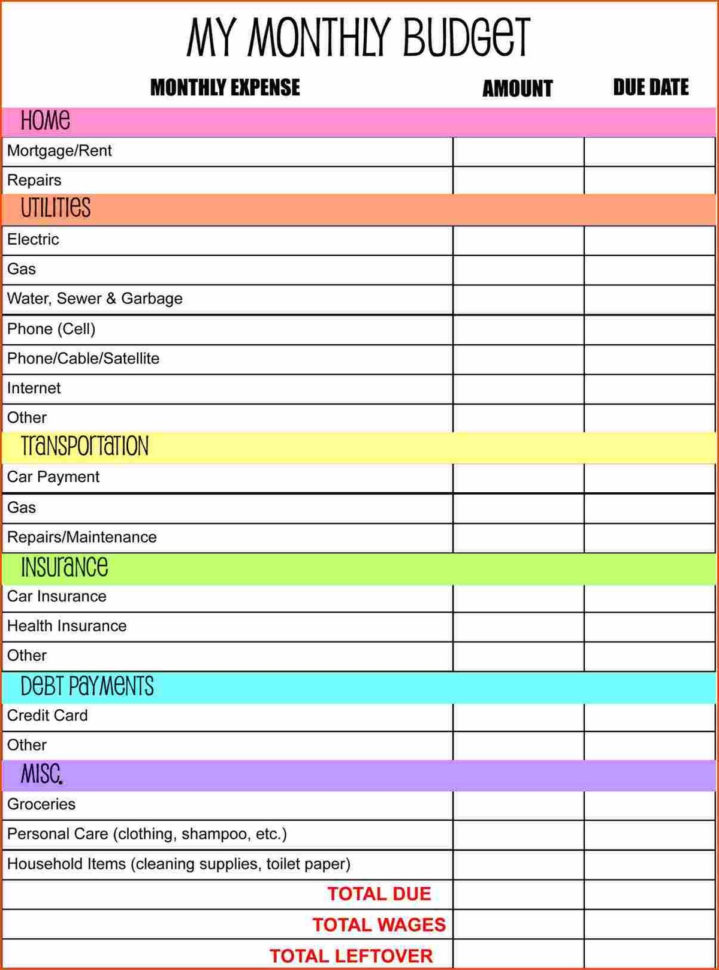

Whether you're a seasoned financial planner or just starting, a well-structured budget is essential. There are myriad ways to approach budgeting, from using pen and paper to employing sophisticated financial applications. However, for many, the simplicity and accessibility of a budgeting spreadsheet offer an ideal starting point. A spreadsheet allows you to visualize your financial landscape on a single page, providing a clear overview of your income, expenses, and savings goals. This clarity is crucial for making informed financial decisions and staying on track.

- Discover Julie Green Ministries Prophecies Faith Hope

- Roberto Esquivel Cabrera Worlds Longest Penis Is It A Curse

Consider the experience of someone who, initially, used the EveryDollar app. While the app offered visual appeal, the user ultimately desired a more comprehensive view of their finances on a single page. This preference highlights a common sentiment: the need for a budgeting tool that provides a holistic perspective. This is where a customized spreadsheet shines, offering the ability to meticulously track income, allocate funds for various expenses, and meticulously monitor itemized expenses. The goal is to ensure that every dollar of income is accounted for and effectively managed.

The beauty of a budgeting spreadsheet lies in its adaptability. You can tailor it to your specific financial needs and preferences. Create sheets for each month, where you can meticulously record every transaction. You can also set up a master budget sheet that provides a comprehensive overview of your financial state. Many individuals find that the ability to see their budget juxtaposed with their actual expenses provides invaluable insights into their spending habits, enabling them to make necessary adjustments.

The concept of budgeting, in its essence, is about directing your money. When you create a monthly budget, you actively decide where your money goes. This proactive approach prevents the frustrating experience of wondering where your money vanished. Instead, you have a clear plan, outlining your income, allocating funds for expenses, and prioritizing savings and debt repayment.

The process of creating a monthly budget can be simplified. Begin by gathering all your financial data, including income sources, recurring expenses, and any outstanding debts. Next, categorize your expenses to identify spending patterns. Determine your income and then create a budget based on it. Allocate funds for your various expenses, ensuring that every dollar of income is accounted for. Finally, track your spending, comparing your actual expenses with your budget, and make adjustments as necessary. This iterative process ensures that your budget is realistic and aligns with your financial goals.

There's no single "best" way to budget; the ideal method depends on your individual needs and preferences. Some may find the ease of use and visual appeal of dedicated budgeting apps like EveryDollar appealing. Others might prefer the flexibility and customizability of a spreadsheet. Ultimately, the most effective budgeting method is the one you can consistently adhere to. This consistency is key to reaching your financial goals.

For those seeking to delve deeper, there are various free resources available. Financial blogs often provide valuable insights, tips, and templates. Many offer free budgeting spreadsheet templates, including cash flow budget spreadsheets inspired by the Dave Ramsey budgeting methods. The "It's Your Money" blog lists several of these free budgeting spreadsheets.

One popular method is the "box budget" spreadsheet, which breaks down each month into four weeks, offering an easy visual overview of your expenses, savings, and income. This visual approach simplifies the budgeting process, allowing you to quickly identify any areas where you may need to adjust your spending. This is especially helpful when looking to get your finances under control.

The "debt snowball" method, inspired by Dave Ramsey's approach, provides a strategic way to tackle debt repayment. The basic idea behind this approach is to pay off your smallest debt as quickly as possible. While the debt with the lowest balance is paid first, regardless of interest rates, the satisfaction of quickly eliminating a debt can be a significant motivator, creating a positive feedback loop and encouraging consistent financial progress. A "debt snowball" spreadsheet can assist with this process, helping to keep track of your debts and your progress in repaying them.

Budgeting is a dynamic process that demands consistency and a commitment to your financial well-being. Whether you are using a paper budget, a dedicated app like EveryDollar, or a free budgeting spreadsheet, remember to make your budget work for you. It may take trial and error to find the best method for your situation. Be proactive, diligent, and open to adapting your approach as your financial circumstances change.

As you begin or continue to use budgeting spreadsheets, it is important to remember a few key pieces of advice. First, consider your overall financial goals. Decide how much you would like to save each month and what you plan to accomplish with those savings. Having a goal in mind can keep you focused and motivated as you work through your budget. Take the time to track your finances in detail, and examine every transaction and expense. Track even small expenditures, and be honest with yourself about where your money is going. If there are any areas where you spend beyond what is ideal for you, the budgeting process gives you the opportunity to identify those areas and work towards adjusting them.

Furthermore, consistency is key when it comes to financial planning. Use the same methods consistently and regularly check your budget. Set reminders in your calendar to check your budget weekly or monthly. Check your transactions and update your numbers as needed. If the process proves too difficult to do on your own, seek the advice of a financial planner or a financial advisor. They can help you through the most complicated aspects of financial planning.

Remember, the journey to financial freedom is not a sprint; it is a marathon. There will be ups and downs, but by consistently utilizing budgeting tools, you are giving yourself the best opportunity to gain control of your finances and achieve your financial goals. A well-managed budget becomes your most potent weapon in the pursuit of financial security and future prosperity.

For those looking for more information on the Dave Ramsey method, you can find useful information on his website. There are also many resources on the internet that offer budgeting spreadsheets and advice. There is no need to spend a lot of money on budgeting tools, as some of the best tools are free and can be customized to your own personal needs.

Here is a table that could potentially be inserted into a WordPress page to provide readers with a brief guide to the benefits of budgeting, or to display general resources for building your own budget. The format is designed to be easily pasted and replicated in the WordPress environment.

| Aspect | Description |

|---|---|

| Financial Control | Gain a clear understanding of your income and expenses, allowing you to manage your finances effectively. |

| Goal Setting | Helps set financial goals, providing a roadmap to achieve them, such as saving for a down payment on a house or paying off student loans. |

| Debt Management | Provides a way to track and manage debt repayment, enabling you to get out of debt. |

| Reduced Stress | Reduce financial stress, knowing your income and expenses are properly managed. |

| Increased Savings | Identify areas where you can reduce spending, freeing up money for savings and investments. |

| Financial Awareness | Learn more about spending habits, allowing you to make informed financial decisions. |

| Flexibility | Adaptable to your specific financial situation, allowing you to manage your finances. |

| Resource Availability | Many free resources are available, including budgeting spreadsheets, debt management tools, and advice from financial experts. |

The world of budgeting has many forms and offers many different options. Some of those are the budget app, EveryDollar, and several free budgeting spreadsheets. Whether you choose the simplicity of a spreadsheet, or the more advanced features of a paid budgeting app, the most important aspect of successful budgeting is consistency. Budgeting can be a powerful tool for individuals seeking financial freedom, providing the structure and knowledge to make informed financial decisions. By developing a budget, creating a spending plan, and using tools such as the debt snowball spreadsheet, you can take steps today toward achieving financial wellness. Remember, the key to financial success lies not in complex formulas, but in the consistency of making your money work for you. Embrace the power of budgeting, and watch as your financial future transforms for the better.

- Jonathan Ponds Montclair Remembers Its Superintendent

- Natalia Vodianova Born February 28 1982 Early Life Career