Are you grappling with the complexities of property taxes in Miami-Dade County? Understanding the nuances of paying your real estate taxes is crucial for every property owner, as failure to do so can lead to significant financial repercussions, including the potential loss of your property. This article will guide you through the essential aspects of property tax payments, ensuring you stay informed and in control of your financial obligations.

Navigating the system of property tax payments in Miami-Dade County can sometimes feel like traversing a maze. The process, while designed to be efficient, can still be confusing for many. This guide will illuminate the various methods for paying your real estate taxes, including online options, payment deadlines, acceptable forms of payment, and potential implications of late payments. It aims to empower property owners with the knowledge needed to manage their tax responsibilities effectively and avoid costly penalties.

Understanding property taxes in Miami-Dade County is essential for every homeowner. The county offers several ways to pay these taxes, including online, by mail, and in person. But the process isn't always straightforward.

- Exploring Parker Center 1 Police Plaza Unveiling History Locations

- Grace Spoonamore Case Details What Happened Next Latest

Here's a detailed look at the process:

- Online Payment: You can conveniently pay your real estate property taxes online.

- Payment Methods: Accepted payment methods include e-checks, credit cards, and debit cards.

- Convenience Fee: There is a convenience fee of 2.39% for online credit card payments.

- Payment Deadline: Payments are accepted online until May 31, 11:59 p.m.

- Mail-in Payment: If paying by mail, payments must be received in the tax collector's public service office by Friday, May 28. Acceptable forms of payment include personal checks and cashier's checks.

- Late Payment: Real estate taxes become delinquent on April 1 of the following year. If taxes remain unpaid by June 1, they may be sold as a tax certificate.

The following table provides the most important elements of real estate tax payments:

| Key Aspect | Details |

|---|---|

| Online Payment Portal | Visit the taxsys website to begin your online tax payment. |

| Payment Methods Online | Credit Card (Visa, Mastercard, Discover), Debit Card, American Express, Samsung Pay, Google Pay |

| Convenience Fee (Online) | 2.39% |

| E-Check Payments | Not accepted for delinquent or prior year taxes. |

| Payment Methods by Mail | Personal Check, Cashier's Check, Money Orders, Certified Funds |

| Payment Deadline (Online) | May 31, 11:59 p.m. |

| Payment Deadline (Mail/In-Person) | Must be received by Friday, May 28 |

| Delinquency Date | April 1 of the following year |

| Tax Certificate Sale | If unpaid on June 1, a tax certificate will be issued. |

| Payment Discounts | Property owners are encouraged to take advantage of early payment discounts. |

| Tax Estimator | Provides an estimate of real property taxes based on entered information; it is only an estimation. |

The tax collector's office provides various resources to assist property owners. One such program may help with tax deferrals and quarterly installment payments. If you believe your taxes are too high, contacting the taxing authority directly is advisable.

- Ewan Mcgregor Divorce Eve Mavrakis Seeks Custody Details Emerge

- Find Appeal Democrat Obituaries More Your Guide

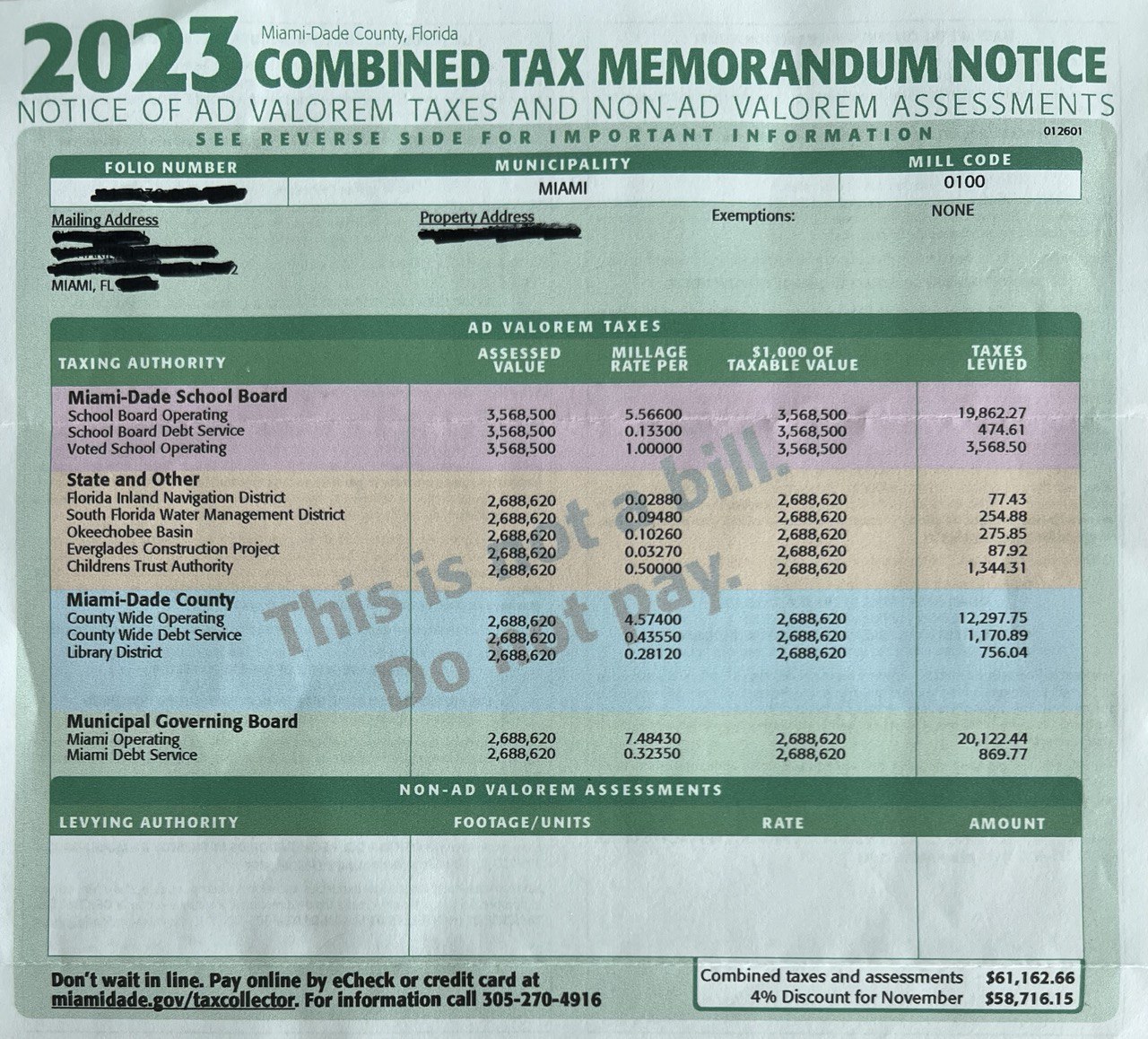

Remember that the property appraiser does not determine the amount of taxes you pay. Their role is limited to assessing property values. Your tax bill is calculated based on the assessed value, exemptions, and the millage rates set by various taxing authorities.

Paying your real estate taxes online offers convenience, allowing you to use e-checks, credit cards, or debit cards. However, keep in mind that e-check payments are not accepted for delinquent or prior-year taxes. When using credit cards, be aware of the 2.39% convenience fee. The tax system is designed to simplify the process, eliminating bureaucracy and prioritizing the needs of residents.

If you prefer to pay by mail, ensure your payment reaches the tax collector's office by the specified deadline. Acceptable forms of payment by mail include personal checks, cashier's checks, money orders, or certified funds. It's crucial to meet these deadlines to avoid penalties.

Failing to pay your taxes can have severe consequences. If your taxes remain unpaid by June 1, a tax certificate will be issued, which means your taxes will be sold. This action puts your property at risk. Therefore, staying on top of your tax obligations is of utmost importance.

The County Assessor's office utilizes recognized appraisal techniques in the annual valuation process. They employ these methods to determine the assessed value of each property. Any changes in property ownership may reset the assessed value to full market value.

To estimate your property taxes, you can use the property tax estimator. This tool provides an estimate based on the information you enter; however, it is important to note that this is just an estimation. For a detailed tax comparison, consider using the tax comparison calculator.

Property owners in Miami-Dade County should be aware of the early payment discounts available. Paying your taxes early can help save you money. For instance, if you pay by January 31, you can save 2% on your gross tax.

Understanding the property tax process is essential. Heres a quick guide:

- Online Payments: Pay conveniently through the taxsys website.

- Payment Methods: Credit and debit cards are accepted (Visa, Mastercard, Discover, American Express, Samsung Pay, Google Pay).

- Fees: A 2.39% convenience fee applies to credit card payments.

- Mail Payments: Checks and cashier's checks are acceptable forms of payment.

- Deadlines: Pay by the deadline to avoid penalties.

- Estimators: Use the tax estimator for a preliminary estimate.

The Miami-Dade County property tax system is designed to be efficient and accessible. By understanding these guidelines, you can effectively manage your property tax responsibilities. For further details and updates, visit the official county website. Regularly checking for updates and staying informed is key to a seamless tax payment experience.

Payments for the current tax year are generally accepted beginning November 1st of the prior year. This gives property owners ample time to fulfill their obligations. Ensure that your payment reaches the appropriate department by the due dates. The deadlines are strictly enforced.

To pay your real estate property taxes online, follow these steps: Visit the taxsys to begin your online tax payment. Make your payment using a credit card, Visa, Mastercard & Discover. Keep in mind that a 2.39% convenience fee applies when using credit cards.

The information provided in the tax estimator tool is for informational purposes only and should not be considered a final tax bill. Various exemptions and special assessments could impact the final tax amount.

Property owners should regularly review their tax bills and assessments. If you have any concerns, contact the tax collector or the taxing authority immediately. Prompt action can prevent potential complications. Always keep records of all tax payments for your reference.

- St Johns County Jail Inmate Scams What You Need To Know

- Exploring Parker Center 1 Police Plaza Unveiling History Locations