Are you tired of the paycheck mystery? Navigating the complexities of payroll, deductions, and taxes can feel like a labyrinth, but understanding your "take-home" pay is essential for financial planning and peace of mind.

The world of California payroll can be intricate, with various federal, state, and local taxes, along with deductions for things like health insurance and retirement plans, all impacting your net earnings. But fear not, because a multitude of tools are at your disposal to unravel this complexity and provide clarity.

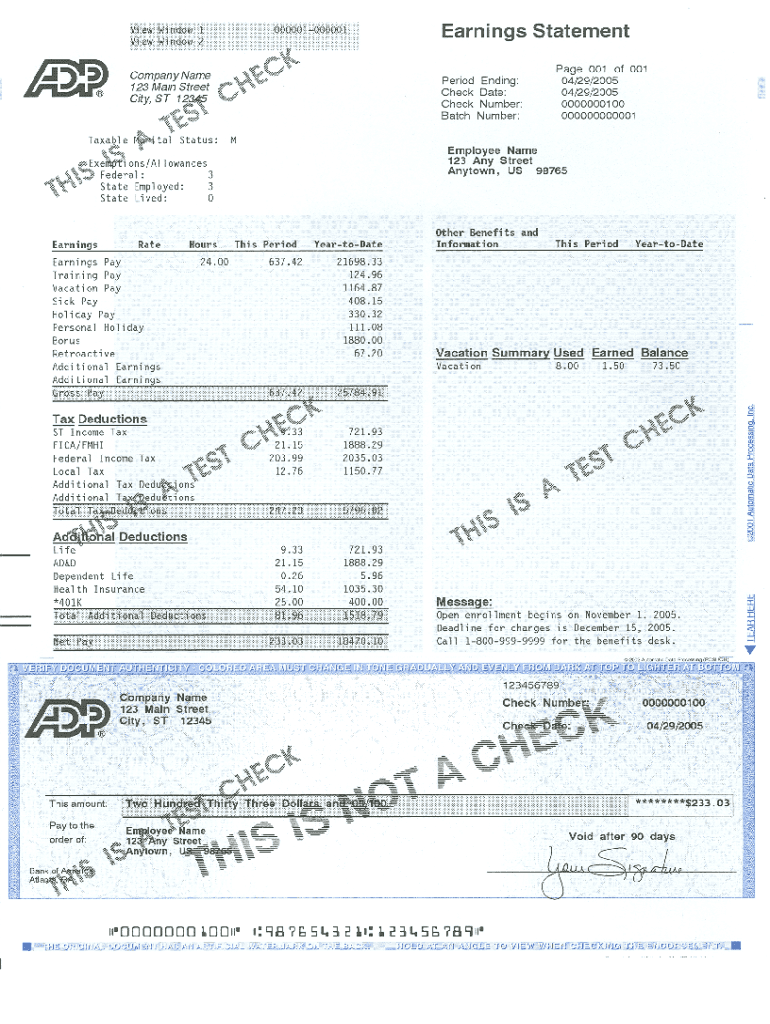

Let's delve into the resources that help you calculate your wages after taxes. One of the most popular and helpful is the ADP California Paycheck Calculator, a tool designed to simplify the process of estimating net pay. With this calculator, you simply input your gross wages, tax withholdings, and any other relevant information, and the tool does the rest, providing an estimate of your take-home pay. This invaluable tool is useful for both hourly and salaried employees.

- Human Latch Horror Gary Mars Terrifying Transformation

- Catherine Mooty Age Net Worth Everything You Need To Know

Beyond ADP, other resources such as Smartasset's California Paycheck Calculator are available. This calculator offers insights into your income after federal, state, and local taxes, helping you to see your income after the deductions are made. Moreover, Roll's salary paycheck calculator is another valuable option, providing financial clarity and pay transparency.

For those seeking deeper understanding, PaycheckCity.com is a robust platform offering California hourly paycheck calculators, withholding calculators, tax calculators, and a wealth of payroll information. These resources are constantly being updated to reflect current tax laws and regulations.The calculator on this page is provided through the ADP employer resource center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data.

The ADP California Paycheck Calculator is a powerful online tool designed to calculate net pay for employees, taking into account taxes, deductions, and other financial obligations. The calculator provides estimates, it is designed to provide general guidance.

- Jennifer Hudsons Son Updates Heartwarming Moments You Dont Want To Miss

- Milan Mirabella Onlyfans Leak What You Need To Know

Another helpful tool is the Netchex California Paycheck Calculator, this will discover what your anticipated paycheck will look like in just a few steps. The calculator provided on this page through the ADP employer resource center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data.

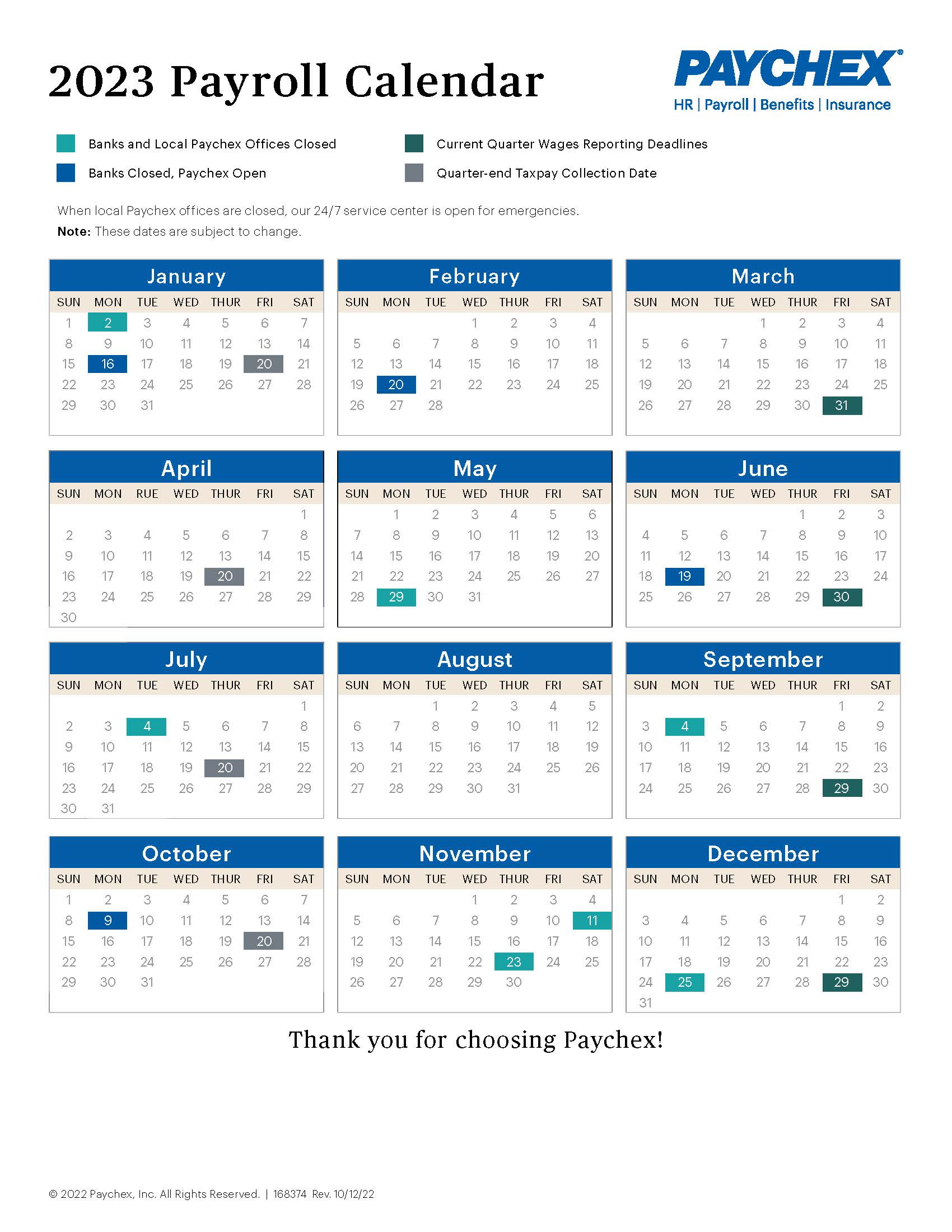

These tools, updated for payroll year 2025 and reflect changes to the W-4 form, consider factors such as marital status, payroll frequency, and the number of dependents. The California monthly salary after tax calculator 2025 offers insight into income tax and salary, based on monthly income, and is optimized for mobile, desktop, and tablet devices.

The California income tax system is a progressive system, meaning that the tax rate increases as income rises. The system has nine tax brackets, with rates that range from 1% to 12.3%. In addition, there's also a top rate, and it's important to understand how the California tax brackets work to get a clear understanding of what is being withheld from your paycheck.

The goal is to simplify the process. Payroll calculations involve many moving parts, including federal, state, and local taxes, plus deductions. The aim is to create a clear picture of take-home pay.

Heres a simplified breakdown of how these calculators work:

- Input your Gross Pay: Enter the amount of money you earned before any deductions. This can be from hourly wages, a salary, or other forms of compensation.

- Provide Tax Withholding Information: This is where youll enter details from your W-4 form (for federal taxes) and DE-4 form (for California state taxes). This includes information like marital status, the number of dependents, and any additional allowances or deductions.

- Specify Deductions: Include any pre-tax deductions, such as contributions to a 401(k) or other retirement plans, health insurance premiums, or other benefits.

- Calculate Net Pay: The calculator will then perform the necessary calculations to determine your net pay. It will deduct federal income tax, California state income tax, Social Security and Medicare taxes, and any other deductions you specified.

- Review Take-Home Pay: The calculator will display your net pay, which is the amount you will actually receive in your paycheck.

Here's the information regarding Social Security and Medicare Taxes:

- Social Security Tax: This tax is 6.2% on earnings up to $147,000.

- Medicare Tax: It is 1.45% on all earnings.

- Additional Medicare Tax: An additional 0.9% Medicare tax applies to earnings over $200,000 for single filers, $250,000 for those married filing jointly, or $125,000 for those married filing separately.

Here's a table summarizing key details:

| Tax | Rate | Thresholds/Details |

|---|---|---|

| Federal Income Tax | Varies | Based on the progressive tax brackets determined by IRS guidelines |

| California State Income Tax | 1% to 12.3% | Based on California's progressive tax brackets, which have rates ranging from 1% to 12.3% |

| Social Security Tax | 6.2% | Applies to earnings up to $147,000 (2024) |

| Medicare Tax | 1.45% | Applies to all earnings |

| Additional Medicare Tax | 0.9% | Applies to earnings over $200,000 (single filers), $250,000 (married filing jointly), or $125,000 (married filing separately) |

The best way to determine the actual taxes, payroll, or other financial data is to consult with a financial advisor or tax professional.

Remember, it's always a good idea to consult with a tax professional or financial advisor for personalized advice.