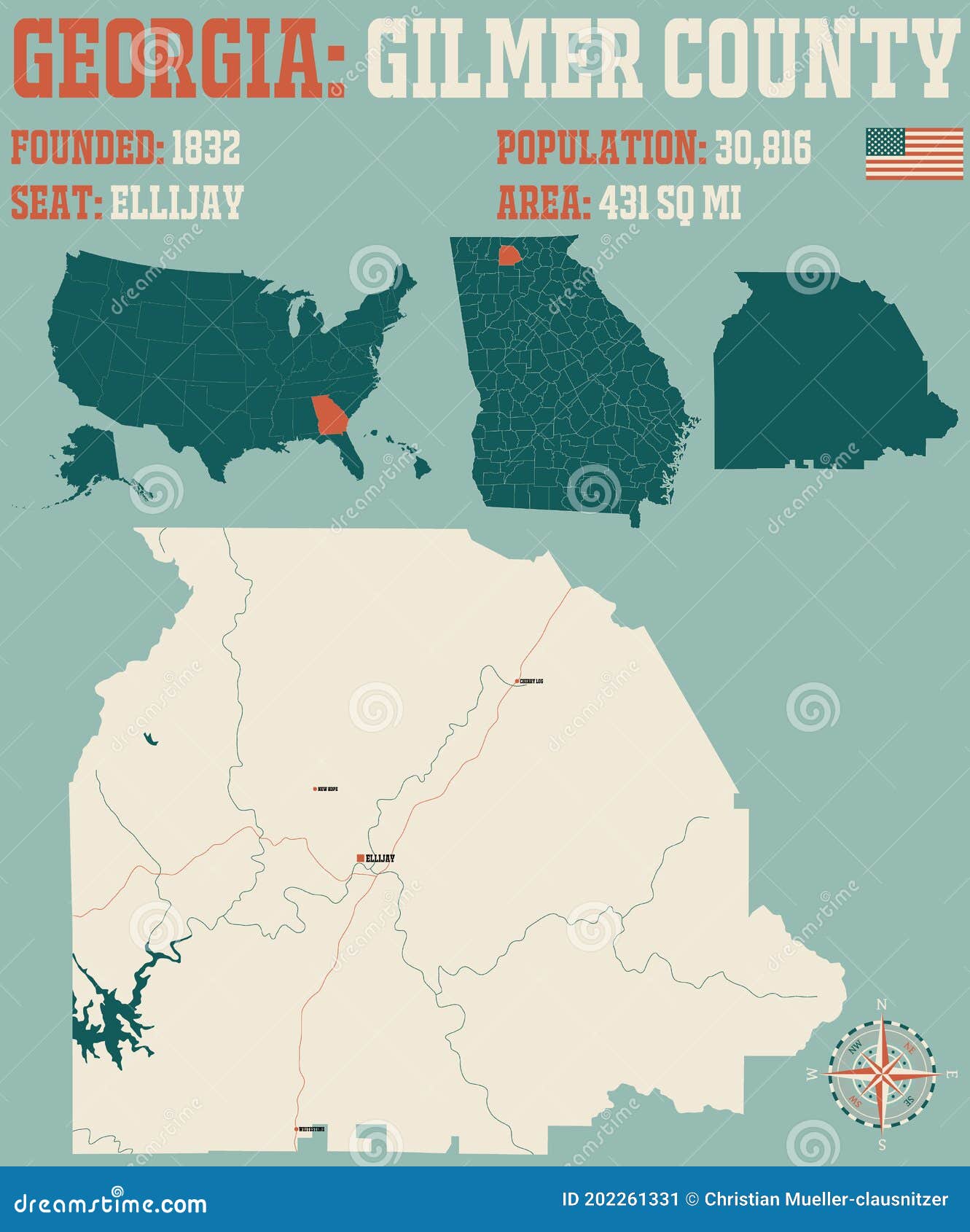

Are you seeking to navigate the complexities of property ownership and taxation within Gilmer County, Georgia? Understanding the intricacies of land records, tax assessments, and online resources is essential for both residents and prospective property owners in this picturesque corner of the state.

Gilmer County offers a wealth of information for those interested in real estate, tax records, and property details. The official sources provide access to a wide array of data, empowering individuals to make informed decisions. From detailed property searches to online payment options, the county aims to provide efficient and transparent services. This comprehensive guide delves into the resources available, ensuring you can readily access the information you need.

The online platform serves as a gateway to a treasure trove of information. Here, you can delve into property details, tax records, and more. The site allows searches based on various criteria, including owner names, addresses, parcel numbers, and legal descriptions. The inclusion of GIS maps provides an additional layer of understanding, offering insights into urban planning, zoning, and other crucial aspects of property within Gilmer County.

- Warren Glowatski Under The Bridge Reena Virks Murder Explained

- Noah Galvin From Broadway To Good Doctor Beyond

Key Aspects of Gilmer County Property and Taxation:

- Property Information: Discover details about property ownership, boundaries, and title searches. Official resources offer comprehensive property information.

- Tax Assessments: The Board of Tax Assessors establishes and defends fair market values for taxable properties, ensuring an equitable system.

- GIS Maps: Explore GIS maps for urban planning, aerial imagery, parcel data, zoning, and flood zones. Utilize GIS services for detailed geospatial data.

- Tax Records: Access tax payment records, property tax records, and public tax records through available resources.

- Online Services: Conveniently process online payments for various services.

- Mobile Home Regulations: Specific regulations apply to mobile homes, including registration and tax obligations.

Delving deeper into the specifics of Gilmer County's resources, you'll find a dedicated online payment page designed for convenience and security. Here, you can process a range of payments, making it easier to manage your financial obligations. Whether you're a property owner or a business operating within the county, the online payment portal streamlines the process.

The countys commitment to transparency extends to property values. The values, as they appear in the "most current published" tax digest, along with preliminary value information for the current tax year, are accessible to the public. This transparency is crucial for residents and investors alike, offering a clear understanding of the property tax system. The Board of Tax Assessors plays a crucial role in this process, ensuring that all taxable properties are assessed at uniform fair market values. This dedication to fairness provides vital information for the Board of Commissioners, the Board of Education, and the City of Ellijay, enabling them to accurately levy and collect property taxes.

- Remembering Anthony Radziwill A Life Of Privilege Tragedy

- James Parsons Iain Armitage News Updates You Need To Know

For those seeking in-depth property data, Gilmer County offers a robust search system. You can locate properties using owner names, addresses, parcel numbers, and legal descriptions. In addition, you may also search by map, or through sales lists, or perform more complex sales searches to analyze data for comparable sales. Whether youre a real estate professional or a prospective homeowner, this search capability is a powerful tool.

The county's GIS maps are particularly valuable for anyone involved in urban planning, construction, or land development. The GIS services provide detailed geospatial data, road maps, district boundaries, road names, and county road numbers. These maps are incredibly useful for understanding zoning regulations, flood zones, and other crucial aspects of land use within Gilmer County.

Homestead Exemptions and Tax Considerations:

- Homestead Exemption: If you own the property, reside on it, and are a legal resident of the county as of January 1st of the tax year, you may qualify for a homestead exemption. Applications must be filed by April 1st of each year, or during the 45-day appeal period.

- Mobile Home Regulations: All mobile homes in Gilmer County must be registered in the Tax Assessor's Office. Failure to pay taxes and obtain permits can result in penalties, including a 10% tax penalty or possible legal action.

- Tax Bills: Bills for mobile homes are usually mailed on January 2nd.

For those interested in mobile home ownership, specific regulations are in place. All mobile homes must be registered in the tax assessors office. Failure to pay the taxes and obtain the permit will result in a 10% tax penalty, potential citation, or even possible sale of the home. Bills for mobile/modular homes are typically mailed around January 2nd each year. This underscores the importance of staying informed about all applicable requirements.

A significant portion of the buildings in Gilmer County were constructed between 1984 and 2006, with a history stretching back as early as 1800. This history informs the county's character, blending modern development with a connection to the past.

To further assist residents, the Gilmer County Board of Tax Assessors maintains a physical presence at 1 Broad Street, Suite 104, Ellijay, Georgia 30540. In addition, there is also an office at 1 Broad Street Suite 105 suite 105 ellijay, ga 30540. The physical presence and the wealth of online resources are testaments to the county's commitment to providing accessible information to the public.

The information available includes property ownership details, boundary lines, and the opportunity to conduct title searches. Moreover, the countys commitment to offering comprehensive information is also apparent in its support for access to tax records. This includes tax payment records, property tax records, and other public records. This commitment highlights Gilmer Countys dedication to transparency and accessibility.

For those seeking information regarding tax assessments, a key point to keep in mind is that the values are established in the "most current published" tax digest. This ensures that the values are based on the most up-to-date information available. This provides the basis for the collection of property taxes, which supports essential services within Gilmer County.

As you explore the resources available, you will find links for tax document retrieval, tax lien records, and information regarding property tax exemptions. This variety of data helps you understand the real estate landscape. This provides a holistic view of property ownership and associated financial obligations.

If you are seeking to find a guide to the local government, the county is a political subdivision of the state of Georgia. The county includes a variety of government services, ensuring that the residents of the county are well-served.

For those in need of assistance, the countys main office is located at 1 Broad Street, Suite 105, Suite 105, Ellijay, GA 30540. You can use this to find the resources, people, and information that you need.

Summary of Resources:

- Property Search: Utilize search tools to find property information by various criteria.

- Tax Information: Access tax records, payment information, and exemptions.

- GIS Maps: Use GIS maps for detailed geospatial data and planning purposes.

- Online Payments: Conveniently make online payments.

- Mobile Home Information: Understand specific regulations for mobile home owners.

In Gilmer County, the process of owning a property and paying taxes is made easier by a dedication to transparency and efficiency. Whether it's a quick search of parcel data, understanding tax obligations, or getting insight through GIS mapping, the county's resources are designed to empower residents and investors. To get detailed information on the county resources, you can visit the official county website.

- Emily Mae Young Step By Step Star Welchs Girl Where Is She Now

- Grace Spoonamore Case Details What Happened Next Latest